2024 Sample Schedule 1 Irs – The Internal Revenue Service (IRS) has revealed new income tax rates for the year 2024, with substantial ramifications for taxpayers. This update affects the way individuals and families will be taxed . The latest annual inflation adjustments report from the Internal Revenue Service (IRS) reveals modifications to income tax brackets and standard deductions for the upcoming 2024-2025 tax season. .

2024 Sample Schedule 1 Irs

Source : twitter.com

What is IRS Form 1040 Schedule 1? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Beneficial Ownership Information for Financial Crimes Enforcement

Source : www.upwork.com

Maryland Democratic Sen. Cardin to announce retirement | The

Source : www.independent.co.uk

IRS Electronic Filing Rules: New E filing Threshold in 2024

Source : www.patriotsoftware.com

2023 Estate and Tax Client Planning Letter

Source : nlfforms.com

King William County | King William VA

Source : www.facebook.com

SylogistEd Instructions Payroll lHelpfulRes/ Owasso Public Schools

Source : www.owassops.org

Lower Your Taxes BIG TIME! 2023 2024: by Botkin, Sandy

Source : www.amazon.com

Trinity Tax Services, LLC | Richland Hills TX

Source : m.facebook.com

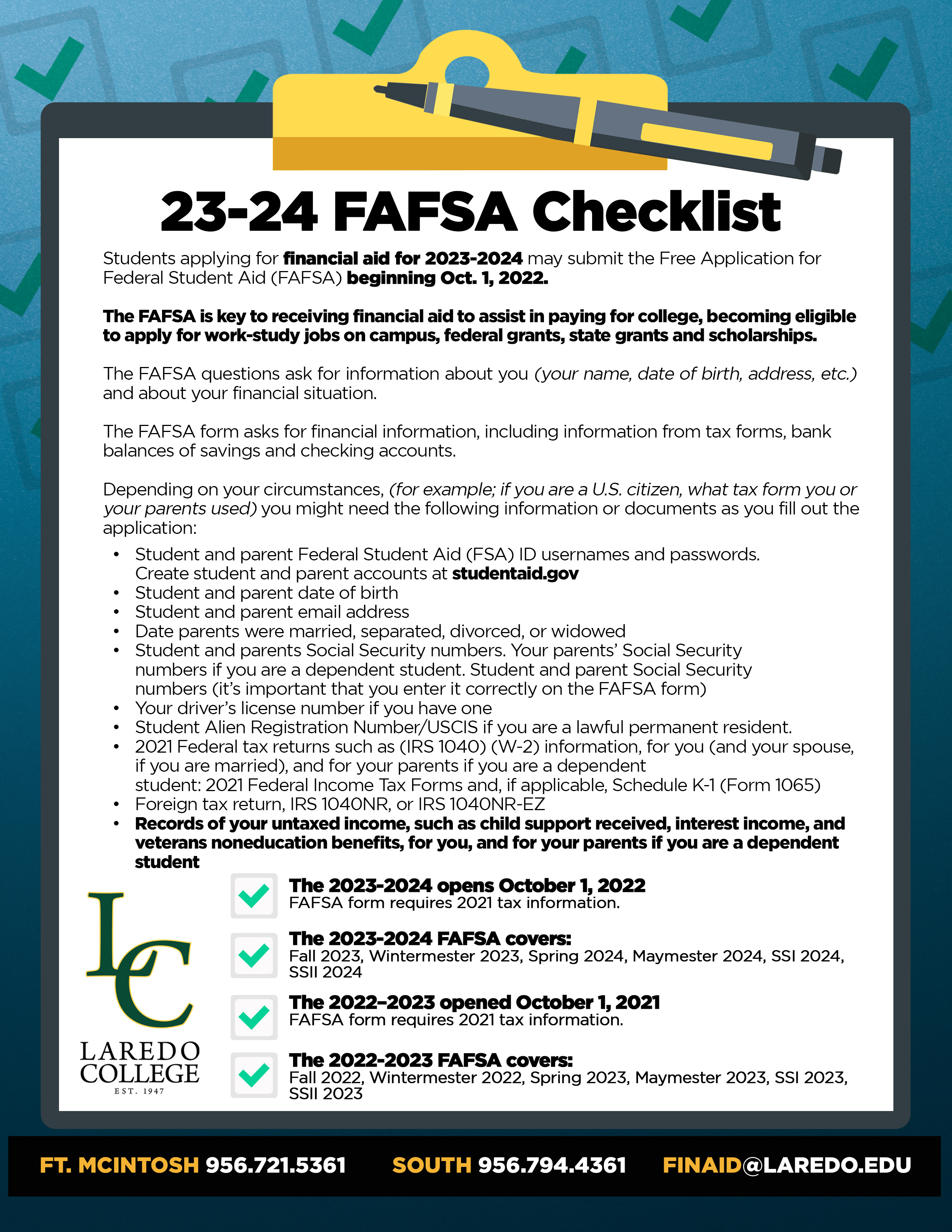

2024 Sample Schedule 1 Irs Laredo College on X: “Need further guidance on how to complete : IRS adjusting have a new 2024 contribution limit of $4,150 for single taxpayers, an increase of 7.8%, while the contribution limit for families will increase to $8,300, or a 7.1% increase . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .