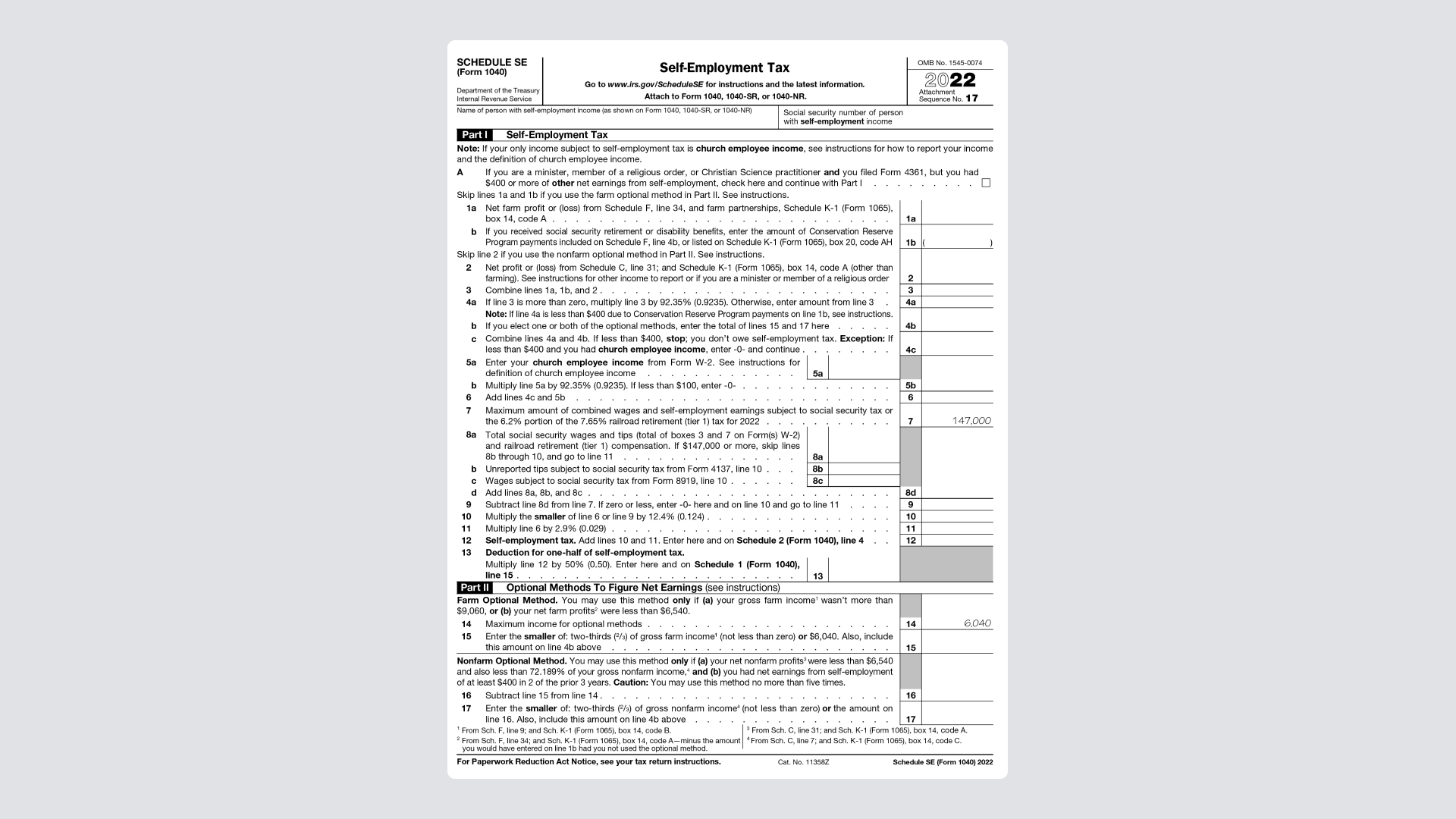

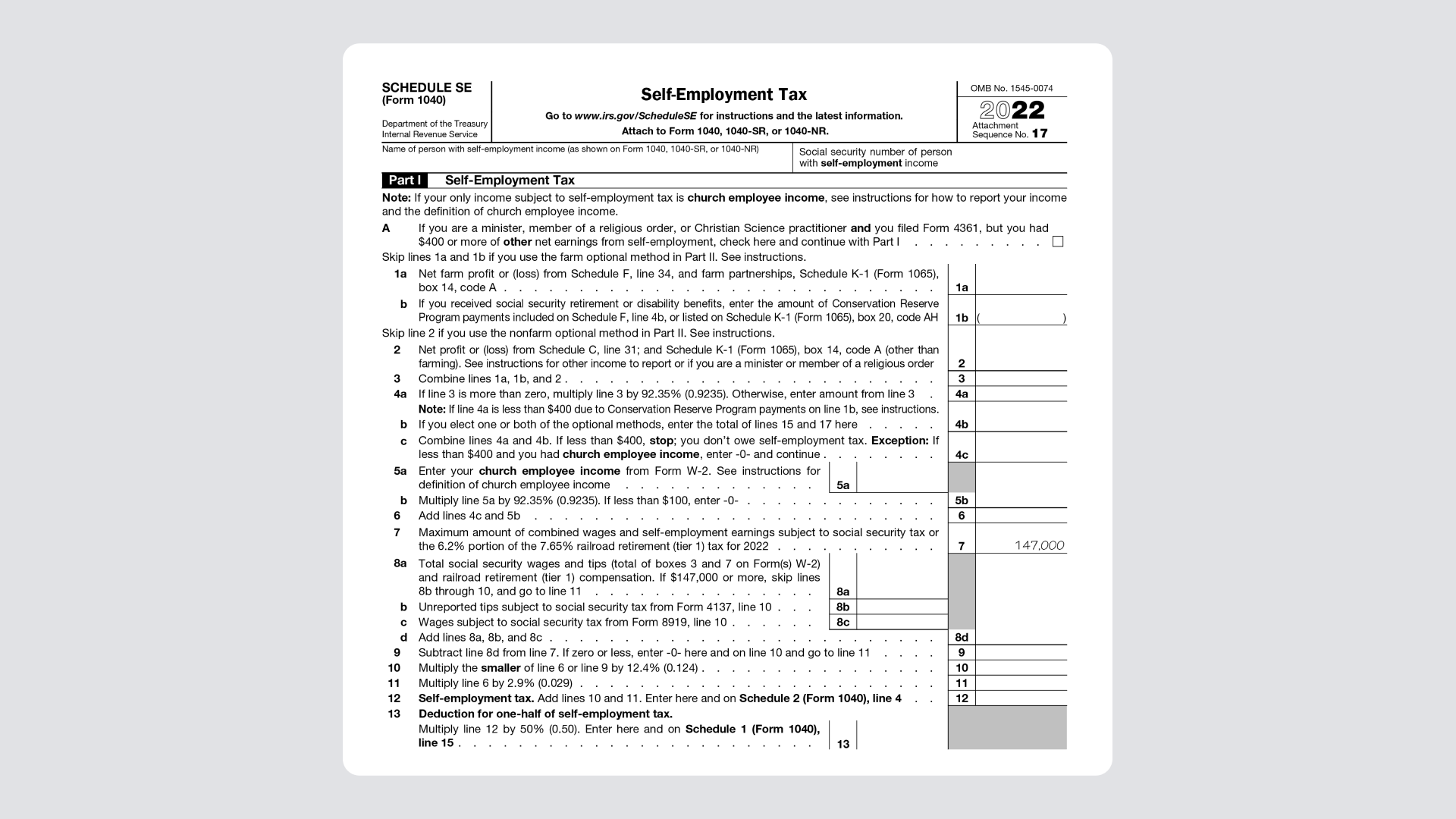

Irs 2024 Form 1040 Schedule Se – Make sure you compare both methods and select the one that benefits you the most. Refer to Schedule 3 of Form 1040 for additional tax credits and complete it as applicable. 9. Calculate Taxes Owed or . The Internal Revenue Service has released its individual income brackets for 2024. Tax brackets are adjusted annually to address “bracket creep,” the name given to describe when inflation .

Irs 2024 Form 1040 Schedule Se

Source : found.com

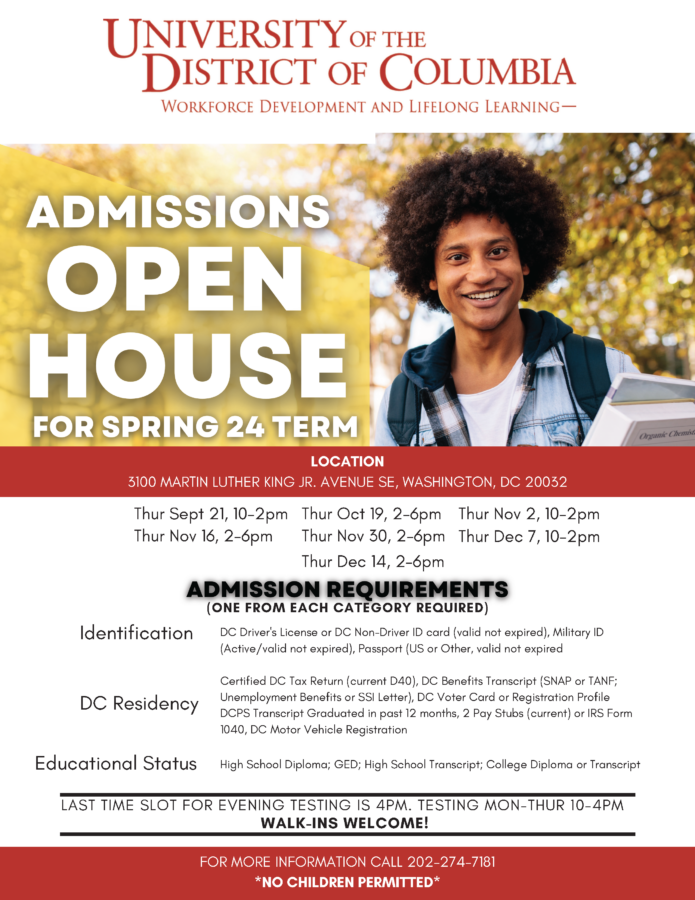

How to Apply and Enroll | University of the District of Columbia

Source : www.udc.edu

IRS Schedule 1 walkthrough (Additional Income & Adjustments to

Source : m.youtube.com

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

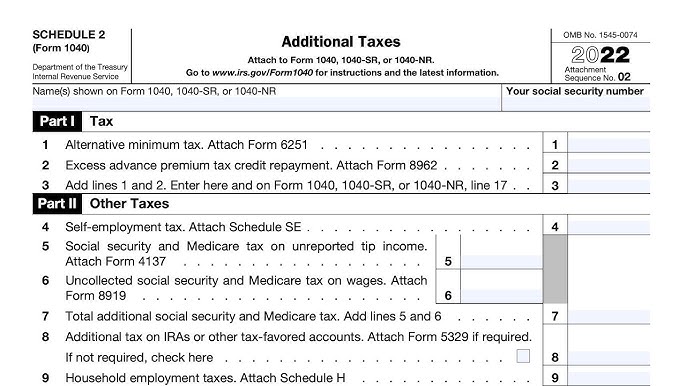

What is IRS Form 1040 Schedule 2? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Publication 560 (2022), Retirement Plans for Small Business

Source : www.irs.gov

Paying self employment taxes on the revised Schedule SE Don’t

Source : www.dontmesswithtaxes.com

Patrick Vergara on LinkedIn: 70+ Ready Made Patterns to capture

Source : www.linkedin.com

Form 1040 Schedule 2 Guide 2023 | US Expat Tax Service

Source : www.taxesforexpats.com

3.11.10 Revenue Receipts | Internal Revenue Service

Source : www.irs.gov

Irs 2024 Form 1040 Schedule Se A Step by Step Guide to the Schedule SE Tax Form: For 2024, the maximum HSA contribution for somebody with self-only The HSA catch-up contribution limit for people age 55 and over is not inflation adjusted, so it remains at $1,000. 0% tax rate if . The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual .